In the financial services industry, staying ahead of the competition and effectively managing risks are critical components of success. With the advent of advanced technologies, location intelligence has emerged as a powerful tool for financial institutions to gain a competitive edge.

By leveraging geospatial data, banks, insurance companies, and other financial organizations can make more informed decisions, personalize their services, and enhance customer satisfaction.

This blog explores the top 5 reasons to use location intelligence in financial services, backed by real-world examples and compelling statistics. Whether optimizing branch locations or improving risk assessment, location intelligence is transforming the financial landscape.

1. Enhance Risk Assessment

- Risk Mapping: Location intelligence helps financial institutions map out high-risk areas for loans and insurance, providing a more accurate assessment of potential risks. By analyzing geographical data, banks can identify regions prone to natural disasters, high crime rates, or economic instability, allowing for more precise risk management.

- Fraud Detection: Geospatial data can identify patterns indicative of fraudulent activities, helping institutions mitigate risks. For instance, sudden spikes in transaction volumes in a specific area may signal fraudulent behavior.

- Example: A bank used location data to identify areas with high loan default rates and adjusted their lending policies accordingly, reducing their overall risk exposure and improving loan performance.

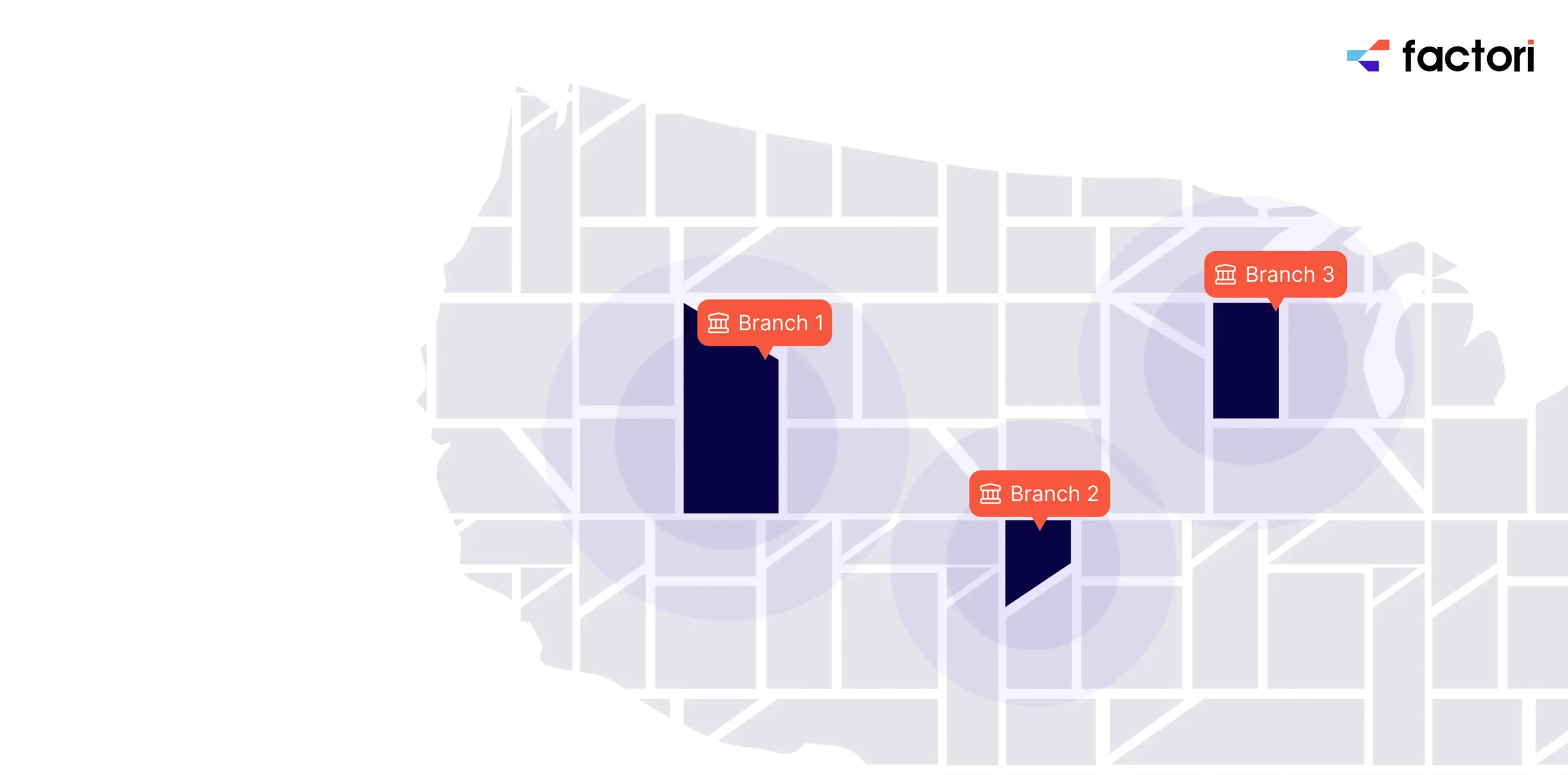

2. Optimize Branch Locations

- Branch Placement: Financial institutions can use location intelligence to determine the best locations for new branches based on foot traffic data, demographic insights, and competitive analysis. This ensures that new branches are strategically placed in areas with high demand and growth potential.

- Customer Accessibility: Ensuring branches are located in areas convenient for target demographics can enhance customer satisfaction and loyalty. Location data can reveal underserved areas where new branches could attract more customers.

3. Personalize Marketing Campaigns

- Targeted Outreach: Location data allows financial institutions to tailor their marketing efforts to specific geographic areas, ensuring more relevant and personalized messaging. By understanding the local population’s needs and preferences, institutions can design targeted campaigns that resonate with their audience.

- Customer Segmentation: By understanding the demographics and behaviors of customers in different areas, institutions can create more effective marketing campaigns. This includes offering region-specific products and services that cater to the unique needs of each market.

- Example: A financial services company used location intelligence to target retirement planning services to areas with a high concentration of older adults, resulting in higher engagement and conversion rates.

4. Improve Customer Experience

- Enhanced Services: Location intelligence can help financial institutions understand customer behaviors and preferences, allowing them to tailor their services accordingly. This includes optimizing branch services, ATM locations, and mobile banking features based on local demand.

- Proximity-Based Offers: Institutions can offer promotions and services based on a customer’s location, increasing relevance and uptake. For example, offering mortgage advice in areas with high property sales or investment services in affluent neighborhoods.

- Example: A bank used location data to offer personalized financial advice and products to customers based on their proximity to certain branches and financial trends in those areas, resulting in improved customer satisfaction and loyalty.

5. Gain Competitive Advantage

- Market Analysis: Location intelligence provides insights into competitor locations and market dynamics, allowing financial institutions to make informed strategic decisions. This includes identifying areas with high competition and discovering opportunities in underserved markets.

- Service Differentiation: By understanding local market needs and gaps, institutions can offer unique services that set them apart from competitors. This differentiation can attract new customers and retain existing ones.

- Example: A financial institution used location data to analyze competitor branch locations and identified opportunities to offer niche financial products in underserved areas, gaining a competitive edge and attracting new customers.

Conclusion

Location intelligence is revolutionizing the financial services industry by providing critical insights that enhance risk assessment, optimize branch locations, personalize marketing campaigns, improve customer experience, and offer a competitive advantage. By leveraging geospatial data, financial institutions can make more informed decisions, deliver tailored services, and stay ahead in a rapidly evolving market.

As technology continues to advance, the integration of location intelligence into financial strategies will become increasingly essential for success. Embracing this powerful tool can help financial organizations drive growth, improve operational efficiency, and achieve greater customer satisfaction.