The Japanese luxury consumer has remained, to a great extent conservative, difficult to identify and reach. According to retail experts, some of the oldest and most loved brands in Japan are still predominantly offline only businesses. To this day, Japanese consumers especially luxury shoppers prefer in-store personalized experiences and customer service in brick and mortar stores. However, with e-commerce players like Rakuten slowly yet steadily gaining ground with USD $31.7 billion in annual sales, luxury brick & mortar stores face a new challenge. They must either keep up with the data capabilities of e-commerce or lose mindshare. Heres where a deeper understanding of your omnichannel retail customer comes into play.

Harnessing Data Enrichment to Identify Luxury Consumers

Luxury brands typically maintain a high-quality CRM database of their customer base and leverage basic marketing techniques. This CRM data can be enriched with additional real-world consumer attributes such as brand affinity, affluence, travel patterns, property price and more, to build a deeper customer persona. Past behaviour such as frequency and dwell time in own or competitor outlets, frequented locations, life and lifestyles patterns can also give marketers valuable data about brand loyalties and potential shopping patterns of luxury consumers. With insights as personalized as these, luxury brands can finally shed the one-size-fits-all approach to luxury audience segments and are answering specific questions about their unique audiences.

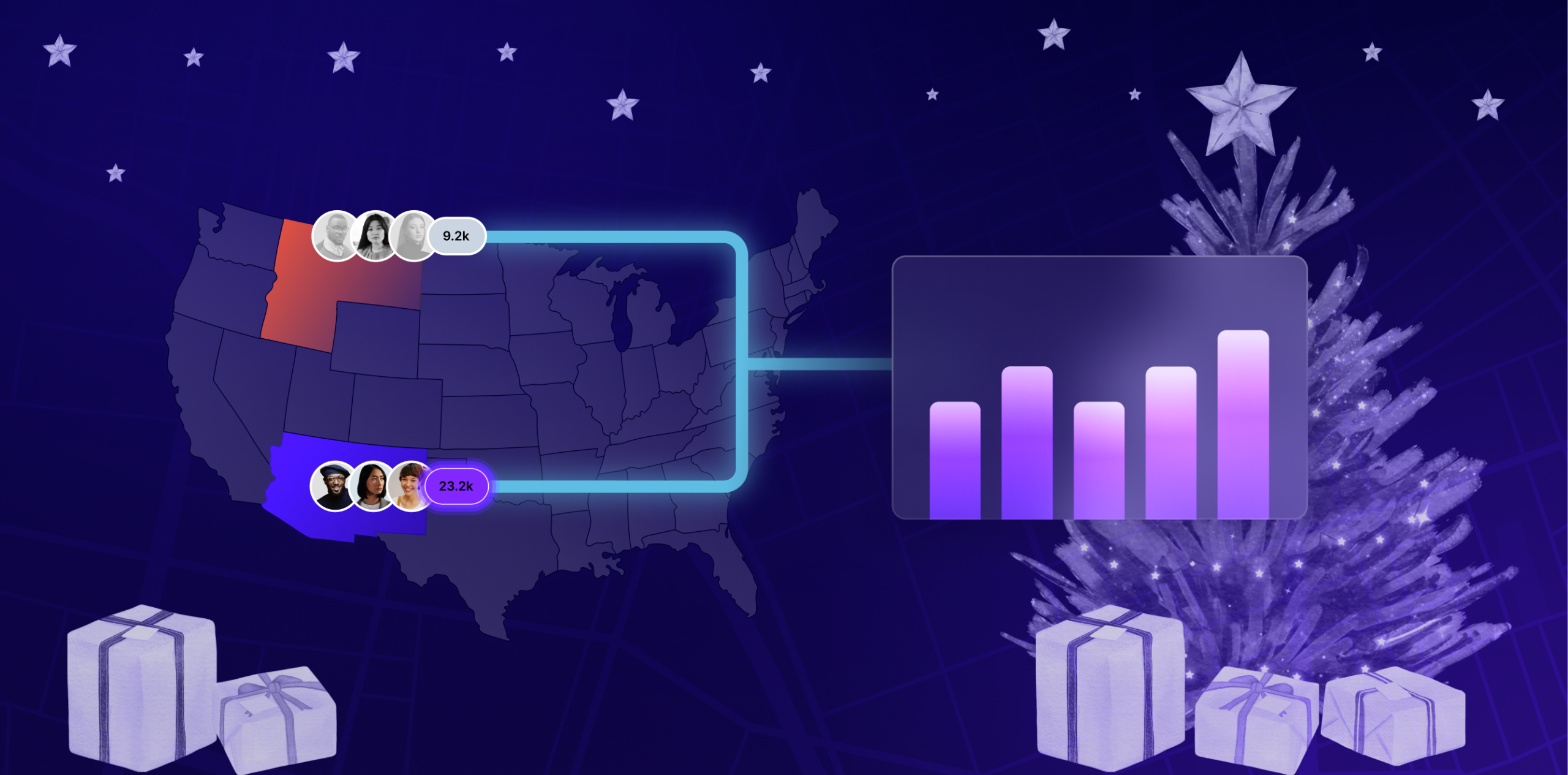

Leveraging lookalike mobile audiences for cross channel targeting

With a more complete customer persona in hand, luxury brands can develop lookalike audience segments that are modelled on real-world attributes. This allows the luxury brands to reach new customers and contextualize their advertising campaigns across multiple channels in terms of digital, TV and OOH, as well as creatives and messaging. Brick and mortar luxury brands already have years of personal relationships and equity with their customers. With a little help from Factori data enrichment solution, these brands can understand and know their consumers like never before. With enriched consumer data, these brands can capture a larger segment of consumers, giving offline luxury retail a significant opportunity to scale their reach and consequently, their business.

You may also like